Check your bank

The new Internet resource Proversvoybank.rf, launched by the Center for the Protection of Depositors and Investors (ANO ZVI), allows anyone to get an analytical report on a Russian bank of interest to him and thereby reduce his risks.

Clients of the service have the opportunity to obtain opinions on the state of the bank based on the results of the financial data of official reporting.

The conclusion will contain information on deviations from the optimal values of indicators - both those established by the regulator and those developed by ANO ZVI for the assessment of credit institutions. The system of indicators developed by ANO ZVI, approximately 3.5 times more often than the system of official standards, allows us to assume a possible problem situation in the bank.

What the dollar is preparing for us

According to economists' forecasts, in autumn the dollar exchange rate will be at the level of 57-62 rubles.

Given the current trends, taking into account the balance of payments and oil prices, there are no grounds for the ruble to weaken, experts say. According to the managing director of the National Rating Agency (NRA) Pavel Samiev, the likelihood that a cap on the Russian public debt will be introduced is minimal, which gives reason not to expect a significant weakening of the ruble.

According to Sergei Khestanov, Associate Professor of the Department of Stock Markets and Financial Engineering, Faculty of Finance and Banking, RANEPA, Russia will not see a change in cash flows until June.

The Central Bank became the owner of Avtovazbank

The Bank of Russia became the owner of over 99.9% of Avtovazbank, according to a press release from the regulator.

These actions were taken by the Central Bank as part of the prevention of the bank's bankruptcy, providing for the acquisition of an additional issue of ordinary shares of the bank in the amount of 350 million rubles, the report says.

On April 20, it was reported that the Central Bank approved changes to the plan for its participation in preventing the bankruptcy of Avtovazbank, which provide for an additional capitalization of the bank by 350 million rubles.

Since April 5, the functions of the temporary administration to manage the bank have been assigned to the management company of the Banking Sector Consolidation Fund (FCBS).

The Central Bank noted that the measures provided for by the plan will ensure the uninterrupted activities of AvtoVAZbank in servicing customers and fulfilling existing obligations.

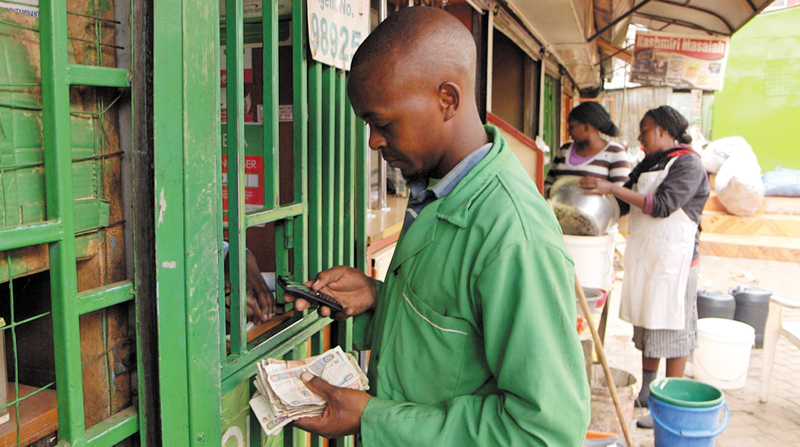

Evolution of payment systems: running after Kenya

Among the leaders in the development of modern payment systems are by no means the most developed countries. Why are they overtaking more developed ones and what is the place of Russia in this process?

Where to look for a cashless future

The evolution of payment systems is inextricably linked with the development of society.

Less than a century after the first bank card was issued, we clearly see the outlines of a cashless financial future for everyone. However, it is worth looking for its prerequisites not only in the bowels of the developed markets of Europe, Great Britain and the USA, but also in the rapidly developing markets of the BRICS countries and other young economies, where the introduction of new payment instruments is happening at a faster pace. Unlike market innovations in developing countries, the impetus for the development of a new infrastructure of payment systems in Europe and the United States is the rigidity and incompatibility of the standards of various markets or giants, but this is also undergoing changes under pressure from regulators.

The second payment directive and the subsequent open banking initiative in the UK (open banking) stimulates the formation of standards for access to bank accounts and the implementation of operations on them, which also forces payment systems to actively promote new solutions - information aggregation, secure storage of personal data and their ubiquitous offline and online use.

Mobile money in Swahili

For example, in Kenya today, more than half of the population uses mobile banking - including those who did not have access to a full-fledged education and whose income is extremely low.

In the recent past, this African country launched one of the most innovative money systems in the world, the M-Pesa service (“m” means “mobile”, pesa means “money” in Swahili). This service works on mobile phones and Android smartphones, allowing its users to send money to other subscribers as easily as they send SMS. As a result, more money transfers are made through M-Pesa in Kenya alone on a daily basis than through Western Union worldwide. Thus, while mass mobile banking is only a dream in some developed countries, in Kenya it has already become a daily reality. To match Africa and Latin America. More than 700 million bank cards have been issued in Brazil, more than three per person. More than 77% of the population uses credit cards. The number of points of acceptance of bank cards is approaching 5 million. With modern technologies for accepting payments on smartphones and tablets in Brazil, there will soon be no places at all where it will not be possible to pay for goods or services without cash.

Money of Russians deprive of anonymity

How will the financial market change after the ban on the sale of bearer products?

Anonymity is illegal

Starting from June 1, 2018, it will not be possible to open a deposit or a bearer bank card.

Also under the ban are unnamed savings certificates, savings books (in fact, a security certifying the fact of a deposit), transfers to anonymous wallets registered in Russia. The motive for this decision is to increase the transparency of the financial system and the next step in the fight against the financing of terrorism and money laundering. The ban on the opening of anonymous products was legislatively formalized by amendments made by our legislators to the 115th federal law "On counteracting the legalization (laundering) of proceeds from crime and the financing of terrorism."

According to these amendments, credit institutions are prohibited from entering into bank deposit (deposit) agreements with the execution of documents certifying the bearer deposit (deposit). The document states that transactions during which the placement of funds in a deposit (on a deposit) with the execution of documents certifying a deposit (deposit) to a bearer take place cannot be performed by banks at all. Such transactions are excluded from the list of transactions subject to mandatory control - they simply should not remain in banking practice. Changes to 115-FZ will come into force on June 1, 2018: after this date, new anonymous products will not be sold.

What is this wallet?

Anonymous wallets that are technically located outside of Russia are not affected by the new version of the law - the changes concern only banking instruments regulated by Russian law.

But those wallets that are in Russian jurisdiction will be affected by the new requirements.

Anonymous electronic wallets are used, as a rule, to make small operational payments - repayment of microloans, small transfers, parking fees. If the payment amount is less than 15 thousand rubles, then identification of the client is not required to make the payment. If you plan to work with a larger amount, you will have to identify yourself. “The rejection of this tool will first of all complicate the life not of terrorists, but of individual entrepreneurs, micro-businesses and self-employed citizens – they will have to solve their problems with the help of bank cards and accounts. As a result, not criminals will suffer, but the electronic payment business: part of it will be cut off.

DOWNLOAD

DOWNLOAD LOOK

LOOK

Top Content of the Month

Top Content of the Month